iowa capital gains tax farmland

The governors proposal would allow any farmer over age 55 to exempt income from cash rent of farmland as well as capital gains from land sales. Covered by US.

Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction.

. Internal Revenue Code Section 453 a Monetized Installment Sale MIS is a method that sellers can use to defer capital gains taxes over a period of two to 30 years while receiving cash via a loan taken against the sales proceeds. Iowa is a somewhat different story. Apply the Iowa capital gain deduction to proceeds from the sale of farm in the current or succeeding tax years see Division III below for new relevant law.

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax. This provision applies to tax years beginning on or after January 1 2023. Is capital gains tax 30.

By Joe Kristan CPA. The Department of Revenue engaged in the process of drafting administrative rules. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

Iowa Supreme Court Nixes Capital Gain Break for Sale of Cash-rent Farmland. Iowa has a unique state tax break for a limited set of capital gains. Grain Bin Exemption Guidance.

Why would we want a tax policy that would worsen the problem. Iowa Code section 4233 subsection 16A to exempt the sale of a grain bin from sales and use tax. June 23 2020 Blog.

The deduction must be reported on one of six forms by completing the applicable Capital Gain Deduction Worksheet. Before you complete the applicable Iowa Capital Gain Deduction IA 100 form review the Iowa Capital Gain. To claim a deduction for capital gains from the qualifying sale of cattle horses or breeding livestock complete the IA 100A.

You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. Lets say our 55-year-old farmer went out on his own in 1994 at the age of 27. Take the beginning farmer tax credit in the current or succeeding tax years.

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests. Under the new law that deduction applies to gain from the sale of farmland and from the sale of dairy and breeding livestock held by retired farmers. The current capital gains tax of most investments is 0 15 or 20 of the profit depending on your overall income.

The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue. Kim Reynolds signed a 39 flat tax on March 1 which will roll back taxes for many farmers but may have the biggest effect on retired farmers. The current statutes rules and regulations are legally controlling.

The exemption went into effect July 1 2019. Instead of electing to have rental income excluded from Iowa taxation retired farmers can instead choose an Iowa capital gain deduction when they sell their farm assets. This prevents a seller from receiving any sale dollars at the time of the sale.

The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue and must be reported on an Iowa Capital Gain Deduction IA 100 form.

With Food Prices Continuing To Climb Un Warns Of Crippling Global Shortages Npr

Land Values And Cash Rents Falling In Some Areas

Farmland 1031 Exchange Agriculture 1031 Exchange

Farmland 1031 Exchange Agriculture 1031 Exchange

Stretching The Hay Supply This Winter Drovers

Little House On The Prairie By Joel Pangoe Rihingan Photography Games The World S Greatest Photography

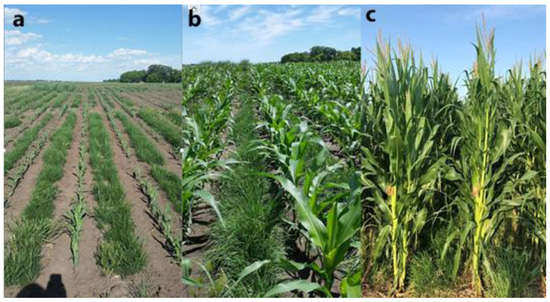

Agronomy Free Full Text Regenerating Agricultural Landscapes With Perennial Groundcover For Intensive Crop Production Html

President Joe Biden S American Families Plan Closes Tax Loopholes Favoring The Superrich While Protecting Family Farme Family Plan Family Farmer Protect Family

Ags 2 Steer According To Plan Topcon Positioning

Grass Fed Cattle Farm Plan Cattle Farming Farm Plans Business Plan Template

Farmland 1031 Exchange Agriculture 1031 Exchange

Farmland 1031 Exchange Agriculture 1031 Exchange

La Nina Is Pushing Up Food Prices And Making Inflation Fears Worse Bloomberg

A Look At The American Families Plan Center For Agricultural Law And Taxation